Wealth, Insurance, and Member Value: Where Product Meets Policy

For high-net-worth clients and conservative savers, wealth planning around digital assets is moving from speculation to structure. Insurance design is evolving (e.g., BTC-denominated policies with audited financials) to support long-term holdings without forced liquidation. Tax publishers now cover basis management, charitable giving, and retirement wrappers—signals that planning, governance, and documentation are catching up to demand.

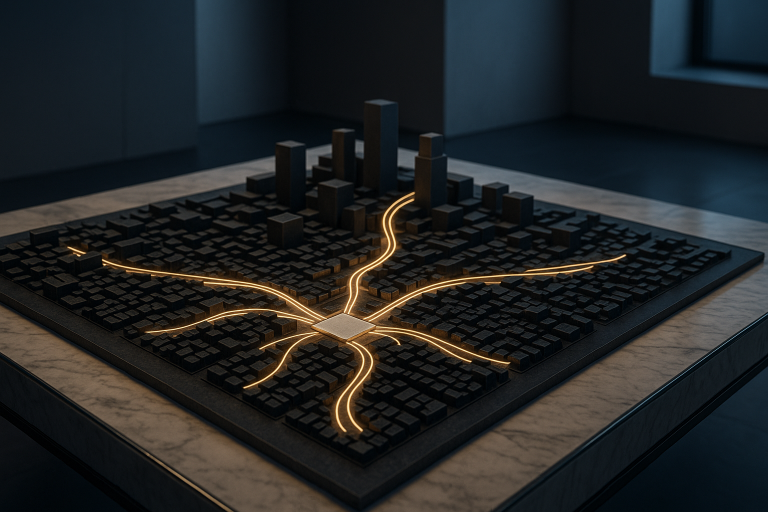

For credit unions, the member mandate is straightforward: deliver the trust and oversight of traditional finance with the programmability and access of digital assets. That means custody with clear beneficiary flows, programmable distributions, stablecoin rails with auditable logs, and portfolio visibility across chains. Aetherum’s stack—tokenization with lifecycle control, compliant transfers, real-time multi-chain tracking, and Wallet Score—gives CUs bank-grade rails from day one.

Member value improves when product meets policy. The outcome is a service that feels familiar to exam teams and safe to members, but modern in speed, flexibility, and transparency. It’s not about flipping on “crypto access”—it’s about operating digital assets to institutional standards.

From Speculation to Structure: Wealth & Insurance Are Normalizing

Two trends define this moment. First, insurers and wealth planners are building long-horizon solutions that don’t require converting digital assets to fiat at every step—premiums, claims, or estate events can be designed around the asset itself. Second, mainstream tax resources are documenting repeatable strategies that help families plan with fewer filing-time surprises.

What does that mean for product teams? Infrastructure must support lifecycle logic (issue → manage → settle/retire), policy-aware events (beneficiaries, distributions, premium schedules), and evidence by design (artifacts examiners can test). With Aetherum, lifecycle tokenization and audit-ready event logs make these use cases governable, repeatable, and explainable.

The net effect is a shift from ad-hoc exceptions to documented, defensible programs. Advisors, trustees, and members get clarity; exam teams get artifacts; operations gets efficiency. Wealth and insurance stop being edge cases and become part of the core service model.

Credit Unions at the Center: Custody, Parity, and Member Value

CU advocates are pushing for parity with banks on digital-asset authorities because members want trusted local institutions to safeguard and move value. As federal clarity on stablecoins and safekeeping advances, the question is no longer “if,” but “on what rails?” Programs will scale where tokenization, transfers, and monitoring are designed to meet ordinary safety-and-soundness expectations—not bespoke exceptions.

Aetherum’s approach is product-first and exam-ready. Programmable tokenization embeds controls at each step; AI-powered compliance adapts as guidance evolves; real-time portfolio tracking gives one source of truth for exposure, diversification, and flow velocity; and Wallet Score standardizes counterparty evaluation with a credit-score-like signal for underwriting, limits, and monitoring.

For conservative institutions, that combination turns momentum into durable lines of business: faster approvals where risk is low, tighter guardrails where it isn’t, and a clear, auditable record of why decisions were made. That’s how CUs deliver modern services without compromising the trust they’re known for.

Request a demo: demo@aetherm.ai